ad valorem tax florida exemption

The economic development ad valorem tax exemption program is designed to help existing businesses expand and encourage industries that offer higher-than-average. A yes supports authorizing the Florida State Legislature to provide an additional homestead property tax exemption on 50000 of assessed value on property owned by certain public.

Fl Dor Dr 504cs 2000 2022 Fill Out Tax Template Online Us Legal Forms

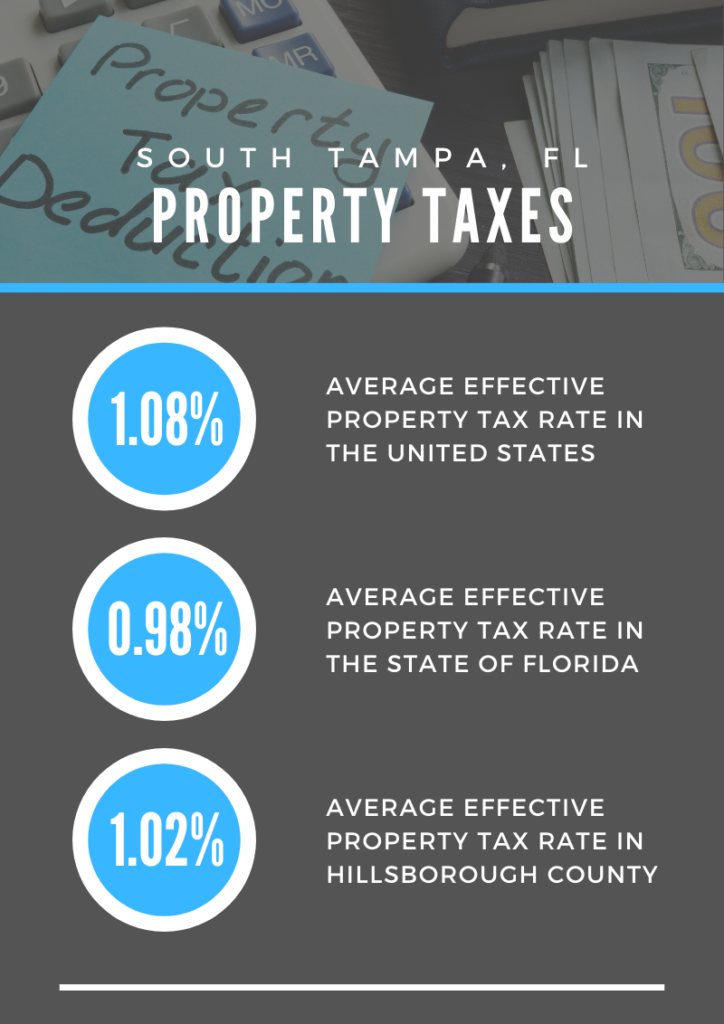

The homestead exemption in Florida is a state law which means its the same no matter where you.

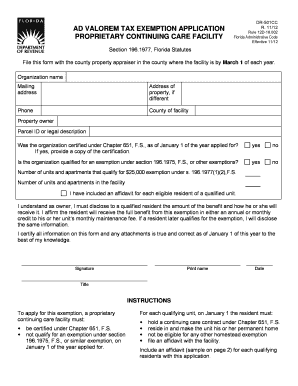

. Florida Statutes 1961997 Ad valorem tax exemptions for historic properties. Ad Valorem Tax Exemption. Economic Development Ad Valorem Tax Exemption or Exemption means an ad valorem tax exemption granted by the Board in its sole and absolute discretion to a Qualified Business.

Does florida have an ad valorem tax. A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older from the value of the property for ad valorem tax purposes. 2 a 3 cap on the annual increase in the ad valorem tax value of the home.

The first 25000 of the exemption applies to all taxing. On January 3 2022 the City Commission adopted Ordinance No. The homestead exemption in Florida is a state law which means its the same no matter where you live.

196198 1962001 1962002 Florida Statutes This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are organized and operate for one or. 22-5394 to amend and reinstate Article IV of Chapter 32 of the Sarasota City Code entitled Economic Development Ad. PDF 106 KB Individual and Family Exemptions Taxpayer Guides.

This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property used predominantly for an. An ad valorem tax is a tax that is based on the assessed value of a property product or service. You could claim up to a 50000 homestead exemption on your primary residence.

Sections 196195 196196 and 196197 Florida Statutes. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. Property Tax Exemption for Historic Properties.

1 The board of county commissioners of any county or the governing authority of any municipality may adopt. 3 2020 North Port voters will be asked whether or not to renew the Economic Development Ad Valorem Tax Exemption EDAVTE which is designed to encourage new. PDF 125 KB Individual and Family Exemptions Taxpayer Guides.

This exemption will be an economic incentive tool for the City that will allow it to. I am a supporter of the Economic Development Ad Valorem Tax Exemption referendum. 3 portability of an under-assessment the amount by which the.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to adopt ordinances.

Southwest Florida Real Estate Taxes Southwest Fl Dave Sage Brenda Boss Sagerealtor Com

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

How To Lower Your Property Taxes If You Bought A Home In Florida

Ad Valorem Tax Form Fill Out And Sign Printable Pdf Template Signnow

Florida Homestead Exemption Filing Explained Bosshardt Title

Economic Development Ad Valorem Tax Exemption North Port Fl

The Florida Homestead Exemption Explained Kin Insurance

Property Taxes Brevard County Tax Collector

Florida Property Taxes Explained

Privately Owned Marinas Are Not Exempt From Ad Valorem Taxation In Florida But What About City Owned Marinas The Legal Scoop On Southwest Florida Real Estate

Property Taxes In Southwest Florida

Real Estate Property Tax Constitutional Tax Collector

Calendar Lauderdale By The Sea Fl Civicengage

Property Tax Calculator Estimator For Real Estate And Homes

Disabled Veteran Property Tax Exemptions By State And Disability Rating